Laydson Group Review: Key Trading Tips for Beginners [laydson.com]

Equities, another name for stocks, grant investors a stake in a publicly traded corporation. It’s a genuine investment in the company, and traders have control over how it runs if they hold most of its shares. The group of equities that are available for public purchase and sale on numerous exchanges is referred to as the stock market. From where does stock originate? To finance their operations, publicly traded corporations issue stock. Those stock issues are purchased by investors who believe the company will grow in the future. Any dividends and increases in the share price are distributed to the shareholders. This article by Laydson Group will disclose the best trading tips to start the journey as a beginner.

Laydson Group Advices Traders To Invest Wisely

It’s far easier said than done to purchase the appropriate stocks. Anyone can observe a stock that has done well in the past, but it is far more difficult to predict how a stock will perform in the future. One must be ready to put in a lot of effort to manage the investment and conduct company analysis if one wants to be successful in investing in individual stocks.

Novice Traders, Stay Away From Individual Stocks

Everybody has heard about a significant stock triumph or an excellent stock selection. Laydson Group says that keep in mind that if one wants to profit from individual stocks regularly, one must know that the market isn’t already factoring into the stock price. Remember that there is a buyer for those identical shares who is just as certain they will make money as there are sellers in the market.

Build A Diversified Portfolio

The fact that an index fund gives a trader instant access to a variety of stocks is one of its main benefits. Laydson Group suggests diversification is crucial because it lowers the possibility that any one stock in the portfolio would significantly impair overall performance, which raises total returns. Purchasing a mutual fund or exchange-traded fund (ETF) is the simplest approach to building a diverse portfolio. Diversification is already incorporated into the products, and traders do not need to conduct any research on the companies that are included in the index fund.

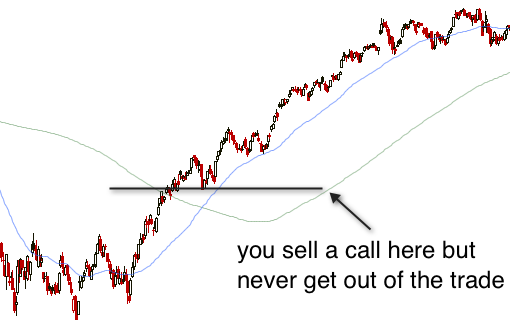

Always Be Ready For A Downturn

For most investors, enduring a loss on their investments is the most difficult problem. traders will also occasionally experience losses due to the stock market’s volatility. they’ll need to prepare themselves to deal with these losses. Any stock one possesses shouldn’t significantly affect their overall return as long as one diversifies their holdings. To learn more about the risk factor go through Laydson Group’s website.

Conclusion

Usually, it’s difficult to pick the ideal moment to enter the stock market and make an investment. No one can say for sure when is the optimal moment to enter. Additionally, investment is supposed to be a long-term endeavor. The ideal moment to begin does not exist. Following these tips, one can get started on their trading journey with Laydson Group.