Essential Tips for Naked Option Writers

Welcome to the high-stakes world of Naked Option Writers! If you’re a daring investor looking to spice up your trading strategy, then this blog is tailor-made for you. Today, we’re diving deep into the risks and rewards of naked options, arming you with essential tips to navigate this exciting but risky terrain like a seasoned pro. So buckle up and get ready to uncover the secrets of successful naked option trading!

Understanding Naked Options

Naked options, also known as uncovered options, involve selling call or put options without owning the underlying security. In simple terms, naked option writers are exposed to potentially unlimited risk if the market moves against their position. Unlike covered options where you own the underlying asset, naked writing requires nerves of steel and a keen understanding of market dynamics.

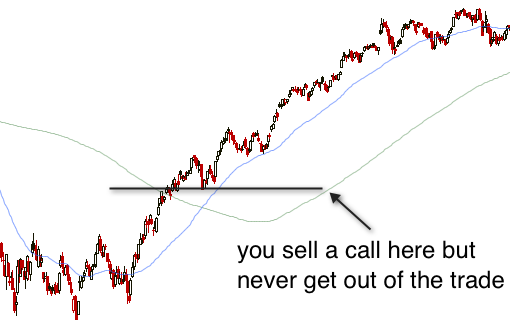

When you sell a naked call option, you’re betting that the stock price will either remain stable or decrease. On the other hand, selling a naked put option means you believe the stock price will stay flat or rise slightly. The allure of naked options lies in their potential for high returns due to premium income but comes with substantial risks.

Understanding how naked options work is crucial before diving into this strategy. It’s essential to grasp both the rewards and dangers associated with this type of trading to make informed decisions and mitigate potential losses.

Risks and Rewards of Naked Option Writing

When it comes to naked option writing, the risks and rewards are like two sides of the same coin. On one hand, the allure of potentially high returns can be enticing for traders looking to capitalize on market movements without owning the underlying asset. However, this strategy comes with its fair share of risks that should not be overlooked.

One of the main risks of naked option writing is unlimited loss potential. Unlike covered options where your risk is limited to the premium paid, naked options expose you to significant downside if the trade moves against you. This can lead to substantial financial losses if not managed properly.

On the flip side, the rewards of naked option writing can be attractive for more experienced traders who understand how to mitigate risk effectively. By collecting premiums upfront and capitalizing on time decay or volatility fluctuations in the market, successful naked option writers can potentially generate consistent profits over time.

It’s crucial for traders engaging in naked option writing to carefully assess their risk tolerance and employ proper risk management strategies to protect their investments while maximizing potential returns.

Managing Risk in Naked Option Trading

When it comes to naked option trading, managing risk is crucial. It’s important to have a clear understanding of the potential downsides and how to mitigate them. One way to manage risk is by setting stop-loss orders, which help limit your losses if the trade moves against you.

Diversification is another key strategy in managing risk. By spreading your investments across different assets or industries, you can reduce the impact of any single loss on your overall portfolio. Additionally, staying informed about market trends and news can help you make more informed decisions when it comes to your options trades.

Risk management also involves being disciplined with your trading plan. Set specific goals for each trade and stick to them, avoiding emotional decision-making that could lead to unnecessary risks. Remember, successful naked option trading requires a combination of skill, knowledge, and careful risk management strategies.

Common Misconceptions About Naked Options

Many traders believe that naked option writing is extremely risky and should be avoided at all costs. However, this misconception often stems from a lack of understanding about how to effectively manage risk in options trading.

One common misconception is that naked options are only for experienced traders. While it’s true that a solid grasp of market dynamics is essential, even novice traders can learn to navigate the world of naked options with proper education and risk management strategies.

Another myth is that you need large sums of money to engage in naked option writing. In reality, there are ways to start small and gradually increase your positions as you gain more experience and confidence in your trading abilities.

Some believe that naked options always result in significant losses. While it’s true that there are risks involved, with careful planning and risk management techniques, many successful traders have found consistent profits through strategic naked option writing strategies.

Conclusion

As you wrap up your journey into the world of naked option writing, remember that knowledge is power. The risks and rewards are real, but with the right strategies in place, you can navigate this complex market with confidence. Stay informed, stay disciplined, and always be willing to adapt to changing market conditions.

Keep honing your skills and never stop learning from both successes and setbacks. Embrace challenges as opportunities for growth rather than reasons for doubt. Remember that risk management is key in any trading endeavor – be proactive in protecting your investments while staying open to new possibilities.

With these essential tips in mind, you’re better equipped to tackle the nuances of naked option writing. Trust yourself, trust your research, and trust the process. And above all else, enjoy the thrill of diving into this dynamic corner of the financial world.

FAQs

Are naked options suitable for beginners?

Naked option writing can be risky and complex, making it more suitable for experienced traders who understand the market dynamics.

How can I manage risk when writing naked options?

To manage risk, consider using stop-loss orders, diversifying your portfolio, and staying informed about market trends.

What are some common misconceptions about naked options?

One common misconception is that naked options always result in significant losses. While they carry risks, with proper risk management strategies in place, they can also offer potential rewards.

By understanding the risks and rewards of naked option writing and implementing effective risk management strategies, you can navigate this trading strategy more confidently. Stay informed, stay vigilant, and always be prepared to adapt your approach based on market conditions. Happy trading!

![Finkea Review: 3 Best commodities to trade in with Them [finkea.com]](https://srune.com/wp-content/uploads/2024/07/unnamed-2.jpg)